Bentley Reid – Investment Views Jan 2024

It was this pronounced deceleration in price growth that ultimately drove last year’s market rally. Had inflation remained

closer to a double-digit pace, policymakers would have struggled to call time on rate hikes, let alone signal that several

rate cuts could emerge this year; a surprise shift in guidance that allowed risk assets to finish 2023 on a high note.

Softer inflation and a Central Bank easing bias are pre-requisites for the “risk-on” mood to endure in 2024, but escalating tensions

in the Middle East have heightened concerns that prices may accelerate again, in turn pressuring policymakers to row back

on plans to cut borrowing costs. Should they do so, investors will likely encounter higher bond yields and a stronger dollar. In

short, a reversal of the trends that helped fuel the bulk of last year’s gains, most notably in the “Magnificent 7” tech stocks,

corporate bonds and the precious metals.

To date, the Israel/Hamas conflict has had a muted impact on markets, but that is starting to change. Since November, the

Houthi rebel group has been escalating its attacks in the Red Sea, specifically targeting commercial ships linked to Israel

and its allies. This is causing severe disruptions to global trade. Many vessels are proactively choosing to re-route via the Horn

of Africa. Others are being forced to do so by their insurers. The result is significantly higher transit costs and lengthy delays

in the time it takes products to arrive at their final destination. If the situation persists for much longer, input costs may rise further and trigger another surge in goods price inflation, akin to what we saw in 2021.

The Houthis are an Iranian-backed rebel group based in Yemen, which has been engaged in an on-off war with Saudi Arabia

since 2014. Following Israel’s invasion of Gaza, they pledged their support for Palestine and, in November, began assaulting

merchant ships travelling through the area. Dozens of vessels have been impacted so far.

Significantly, the attacks are far more sophisticated and dangerous than the normal pirate activity that often blights

the region with the Houthis’ use of missiles and other military techniques proving to be an effective deterrent to maritime

activity. At the time of writing, total Red Sea traffic is down by more than 25%, despite the heavy presence of Western naval

“chaperones” and retaliatory US/UK air strikes on targets linked to the militants in Yemen.

Global supply chains seem vulnerable. Around 15% of all global seaborne trade passes through the Red Sea with exports

flowing from Asia to Europe dominating the route. As Gavekal notes, if a cargo ship sailing from Shanghai to Rotterdam

traverses around the Cape of Good Hope, instead of travelling through the Suez Canal, it adds around 6,000km, several weeks

and potentially millions of dollars to the journey. Indeed, the price of transporting a 40ft container from China to Europe is

up over 300% since early December, although it remains two thirds below its late 2021 peak. Supplier delivery times and order

backlogs for a growing list of Asian-sourced goods are also on the rise, albeit from a low base.

Timing will be key. If tensions ease and navigation routes return to normal within the next few weeks, the spike in container

rates should be short-lived. If not, the risks to goods inflation are skewed to the upside. We would also see more problems for

the likes of Tesla and Volvo, who recently suspended European production lines due to a shortage of parts. With EU-based

electric car makers relying on Asian producers for two-thirds of their battery components, the electric vehicle industry is more

exposed than most to the Middle East unrest.

The parallels to the first wave of inflation are hard to ignore. US goods inflation surged during the pandemic and reached a

staggering 20%y/y peak in February 2022, just as Russia began its invasion of Ukraine. The concern is that supply constraints

return en masse with a possible spike in energy costs amplifying the upside for inflation, given how sensitive the oil price can be

to geopolitical events. This means the likelihood of a second wave of inflation is growing although few of the other conditions

that drove the initial trend are currently in place.

For example, Covid decimated land, sea and air supply chains across the globe, but the disruption is less pervasive this

time around and far more localised. Trucking and air cargo is generally operating as normal and, beyond the Red Sea,

dominant sea-lanes continue to flow.

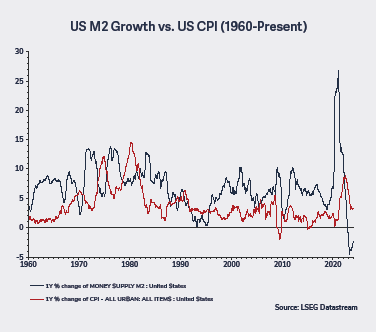

The policy backdrop is also different. Unlike the indiscriminate monetary and fiscal largesse that was deployed during the

pandemic, interest rates are at multi-decade highs and most Central Banks continue to shrink their balance sheets. The

slump in US money supply growth, from a peacetime record +27% y/y in early 2021 to the state of contraction that began in

mid-2023, is representative of the global trend and suggests deflation is the bigger threat. As the chart below shows, money

supply rates tend to be a good lead indicator of CPI.

A sustained period of weak or negative price growth is hard to envisage, but sluggish consumer demand argues against a

return to runaway inflation. The Western consumer was much stronger in late 2020 and early 2021 with US retail sales peaking

at an unprecedented +52%y/y as lockdowns ended. That spending power drove both economic activity and inflation

materially higher, but a repeat seems unlikely given the cost of- living crisis and with the labour market finally slowing after

several years of strong hiring rates and elevated wage growth.

Most significantly, the oil price has failed to catch a meaningful bid, evidencing how softer global growth and

surging American production are countering the Middle East dynamic. Over the course of 2023, US oil output grew from 12.6

million barrels per day (mbpd) to more than 13mbpd; a record quantity that helps to offset ongoing quota cuts by the OPEC+

alliance. Changes in energy costs quickly transmit across the entire supply chain so a becalmed oil market usually helps keep a lid on general price pressures.

All things equal, the fallout from the Red Sea troubles should remain relatively contained. The UK and European economies

appear most vulnerable given their outsized reliance on the Suez Canal trade route, but the resource names that dominate

their equity indices would likely benefit from higher commodity prices, much like they did during the first inflationary wave.

This renders the likes of the FTSE 100 index and cyclical stocks, more generally, an attractive hedge against any future price

shocks, especially after their weak start to 2024.

However, absent a prolonged increase in energy costs, the US economy should be largely immune from the shipping

disruptions, limiting the upside for domestic inflation and allowing the Federal Reserve to proceed with a monetary

easing that sees US rates soon lowered from their 23-year high. This would prevent US bond yields and the dollar from trending

sharply higher which, in turn, should set the stage for a repeat this year of 2023’s bumpy, yet ultimately positive outcome for risk assets.