Melville Douglas – When America Acts

It is an old truism that reflects the large extent to which the United States has been the world’s superpower for a sustained period. Today, there are several emerging challengers for this podium position. Nonetheless, the US economy remains the metaphorical centre of the world in important ways.

Therefore, it makes sense that analysts monitor the US for announcements, policy changes, data releases and more. At the same time, it is critical to understand the limits of America’s impact. In other words, it makes sense to react to economic news from America, but investors should be cautious not to overreact.

Approach to innovation

Think about the growing theme of artificial intelligence (AI). America and China are vying for the top spots, and the rest of the world is competing for third place.

The US has the regulatory environment to nurture the sort of entrepreneurship required. US universities remain the most sought-after, attracting and cultivating talent from across the globe into innovative thinkers that are pivotal to this field. The likes of Stanford University and the Massachusetts Institute of Technology in particular are hubs for thought and action at the nexus of tech and business.

And there is plenty of the right sort of culture for tech entrepreneurship. People come together in places like Silicon Valley, where the ecosystem exists to start, fund and grow all manner of AI-related businesses.

This all speaks to what urban economists call agglomeration economics. This is often applied in the context of big cities. Once a place like New York or London is established as a dominant player in, say, finance, it is very hard for any new entrant to compete. Communities of like-minded pioneers, all in close proximity, all learning from each other, are hard to replicate.

Even more so in the case of AI, where it is not just the technological skills that are needed, but the capital, the infrastructure, and the political buyin. The US already has powerful AI agglomerations, which are very difficult to replicate, affording them high barriers to entry. This hurdle reduces the threat of competition eroding the economic profits of the industry, thereby proving a durable path to financial success.

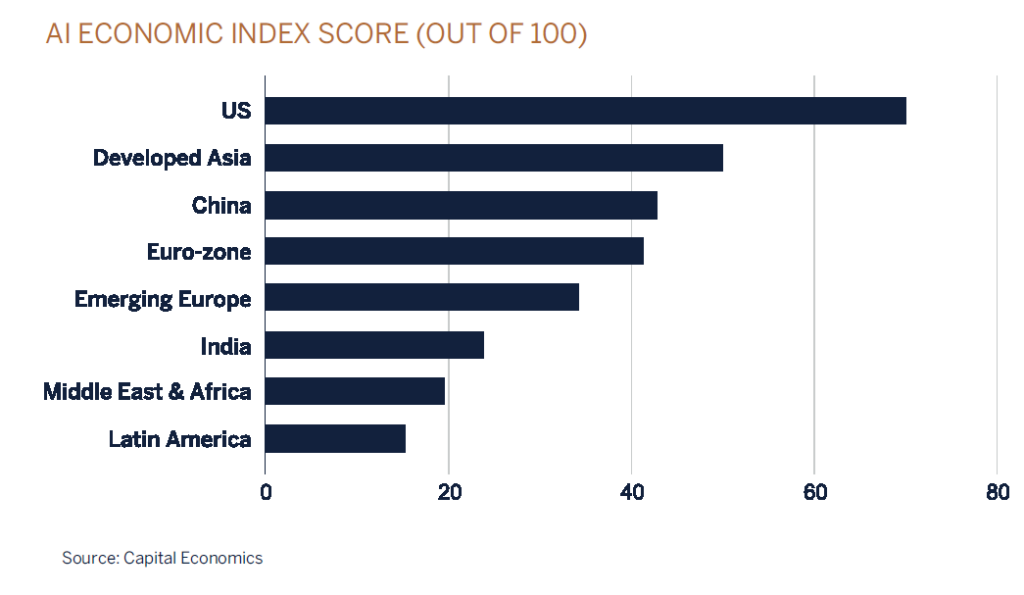

We can back this up quantitatively. Several indicators, including the AI Economic Impact Index from Capital Economics, suggest that the US economy stands out as best positioned overall to benefit from the AI revolution in the decades to come. Their index score puts America well ahead of the rest of the world.

As the authors of the index conclude, “our proprietary AI Economic Impact Index suggests that the US will lead the AI revolution, with the Asian Tigers, UK, Israel, and parts of the Nordics also well-placed to benefit”. They argue that “China will lead some aspects of the AI revolution but struggle in others”.

It is also America’s tech behemoths that top the list of businesses bringing AI to market. Through a combination of acquired and home-grown technology, the likes of Microsoft, Facebook and Nvidia are extremely effective at getting AI

into practical and monetisable shape.

The US government is playing a key role, too. There is a strong effort to bring investment dollars back to the US to improve competitiveness, drive further technological advancements, and improve self-reliance. Many are keen to counteract the trend of recent decades that has seen China become the world’s manufacturing hub. US laws and government spending are backing this up.

The CHIPS Act of 2022 is a prime example. Among other things, it will direct nearly $280 billion in spending over the next decade, focused on US semiconductor manufacturing, research and development, and a growing and inclusive STEM workforce. For the sheer brute force of government budget, very few nations can match Uncle Sam.

The upshot

It is worth landing the size and nature of America’s economic position with two final data points. First, the US can boast half a dozen companies with market capitalisations of $1 trillion or more, using market prices at the time of publication (Bankrate, 2024). Second, no European firm has yet breached $100 billion on this metric.

For the most part, the old adage holds: When America moves, global markets move, too. The important task is deciphering where this relationship holds, the nature of that relationship, and where the link is not quite what some believe it to be.

At Melville Douglas, we focus on identifying the best companies around the world, regardless of where they are listed. In light of the above, the majority of our holdings are US based as they possess wide economic moats that allow them to deliver compounding returns to shareholders over the long run. Just as importantly, we need to determine what is noise and what has already been priced in by the markets.