Ramsey Crookall – Is Cash still king?

On the eve of the Coronation, is cash the investors’ King once again?

Cash has been an afterthought for investors ever since the global financial crisis. In early 2009, the Bank of England lowered interest rates below 1%, and rates never rose above this level until June 2022.

Fast forward to today, and it is possible to achieve interest of over 4% in some bank accounts. Those of you who were born prior to the 80s may see this as a return to the good times. Anyone born after this will view these rates as extremely attractive having probably never seen such a return on cash.

During this time, savers searching for the yields of yesteryear have been encouraged into the bond and equity markets. However, it has been a difficult time for investors with increased volatility due to high inflation exacerbated by the conflict in Ukraine and the subsequent action of central banks increasing interest rates to levels not seen for almost 15 years. Overall, this has pushed the value of equities and bonds lower. Therefore, for those who moved into the stock and bond markets, a potential risk-free yield of 4%+ sounds extremely appealing, right?

On the face of it, we would agree, but does that mean you should sell your assets and place all your funds on deposit at the bank? Not so fast ….

The consequence of economies reopening post-COVID and Russia’s invasion of Ukraine was the reappearance of our old friend inflation. The latest print from the Office of National Statistics (ONS) has inflation in the UK at 10.1%*. What this means is that over the last 12 months, the average cost of goods and services has increased by just over 10%, meaning that whilst the bank may be offering you a 4% deposit rate, your real rate of return is negative (-6.1% per annum, assuming everything stays equal). Although we are not suggesting that inflation is going to stay this high forever, forecasts suggest average inflation of 3.6%, well above the current Bank of England’s 2% target level.

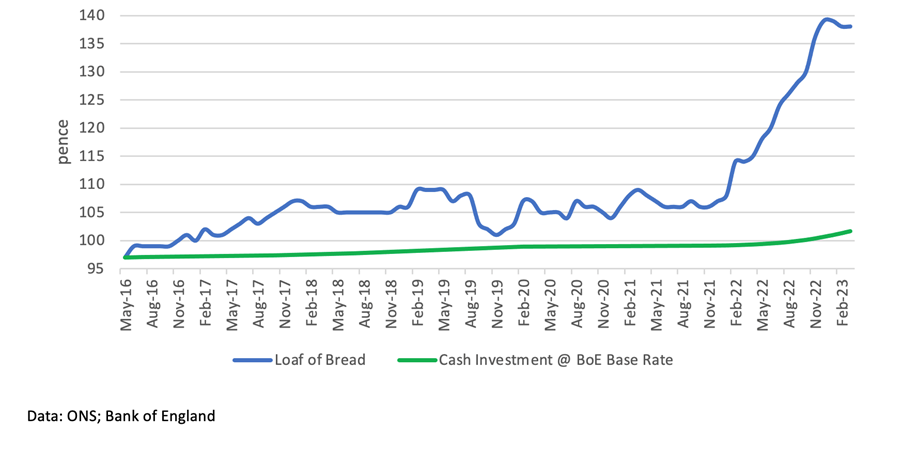

Let’s put this in the context of an everyday item such as a loaf of bread. Over the last 7 years, the average price of a loaf of bread has risen from 97p to £1.38*. That’s a 42.3% increase. Had you managed to achieve the Bank of England’s Base Rate return during the same period, that 97p seven years ago would now be worth £1.02, which is enough today to buy just 75% of a loaf of bread. Someone’s going to go hungry!

Note also that inflation during this period averaged 3.2%*, but we now face a much higher challenge in the form of a double-digit inflation rate. As the cost of goods and services increases, your purchasing power will be eroded, meaning that your cash will buy fewer goods and services in the future than it does today.

In addition, high inflation can cause increased uncertainty for businesses and consumers, who may be unsure about future prices. As a result, they may choose to delay any investment or purchases, leading to reduced economic activity and growth.

In general, high inflation is detrimental to the value and usefulness of cash as a store of value. As such, it is important for individuals and businesses to consider how best to hedge against it, including investing in assets which can offer the potential to provide capital growth to help outpace inflation.

Tools used by asset allocators include long-term capital market assumptions, which are produced by a number of investment banks and draw on qualitative and quantitative inputs as well as insights from experts. Using JP Morgan’s assumptions, the long-term annual returns, defined as 10 to 15 years, are that Sterling cash will return 2.2% per annum, with global equities and UK Gilts producing 6.7% and 4.2% per annum, respectively.

In summary, whilst we are tempted to believe that cash has become an investible asset class once again for those seeking a short-term income safe haven, it should be viewed as part of a wider multi-asset portfolio, which includes important elements for potential growth opportunities required to help combat inflation.