The Bull Market Broadens Out – by Westminster Asset Management

Westminster Asset Management Investment Strategist Peter Lucas considers moves in the precious metals markets. With gold having led the charge over the last couple of years, Peter believes that recent strong gains in other precious metal prices are likely a harbinger for the broader commodity complex.

Despite rising (and latterly, high) real interest rates and general investor apathy, the gold price has doubled in just under three years, propelled by massive central bank buying. In doing so, it has left the broader commodity complex behind, leaving many of them looking crazy cheap by historical standards. For those commodities to return to more normal levels versus gold, either gold must fall (unlikely given the global debt problem), other commodities must rise (more likely), or both rise, with gold taking a back seat (most likely of all). Although the broad backdrop for commodities is not that supportive yet, there are already signs that bottom-fishers are out in force.

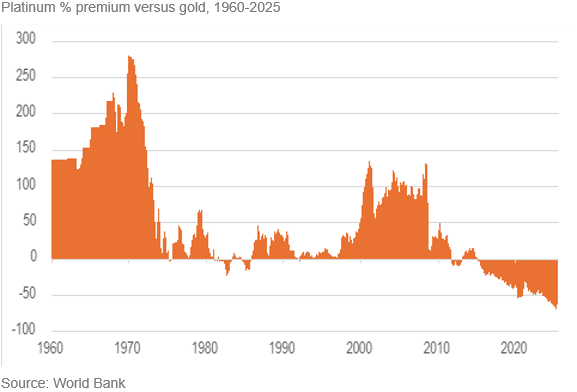

Precious metals have a habit of leading the charge in commodity bull markets; in the global financial crisis, they bottomed 2-4 months ahead of the broader commodity index. This time, with central bank buying centred on gold, the others have been left behind. In the case of platinum , this is not a new development. Rarer than gold, platinum has traded at a premium for three-quarters of the time since 1960. However, in the past 17 years, it has consistently underperformed, partly due to failing demand from manufacturers of catalytic converters. They say that “necessity is the mother of invention” but a low price also helps. One suspected that if it got cheap enough, buyers would appear. Furthermore, with Trump turning his back on the green agenda, demand from the car industry will be likely prove to be somewhat better than many feared just a year ago.

At its April low, platinum was trading at a 70% discount to gold. Since then, it has risen 36% as the trend in the gold has flattened off. The macro backdrop is not yet ideal for platinum, but value is still compelling and for the first time in a while, momentum is starting to look that way as well. If the commodity bull was going to broaden beyond gold, it was logical that it would start with the precious metals complex. The platinum recovery has been particularly impressive, but palladium is also looking perky and the gold/silver ratio has taken out an important support level.

In summary, the precious metals bull is broadening out. Look for other commodity types to participate as the fundamentals improve. Our US inflation indicator is already in accelerating mode, and with easier fiscal policy in the pipeline, growth indicators should also move in a more supportive direction.

Peter Lucas – June 2025